Smith and Koroyd Settle Lawsuits Against Burton

- samgasowski

- Aug 6

- 5 min read

Koroyd SARL, Smith Sport Optics, Inc., and The Burton Corporation settled their patent disputes, which have been ongoing for several years in both Europe and North America. As part of the settlement, the three companies are entering into patent license agreements.

First, some context.

Smith – makers of sports sunglasses and helmets, including helmets for snow sports – has been a longtime partner of Koroyd SARL, a Monaco-based corporation. The first product from the Smith-Koroyd partnership was Smith’s Forefront mountain bike helmet.

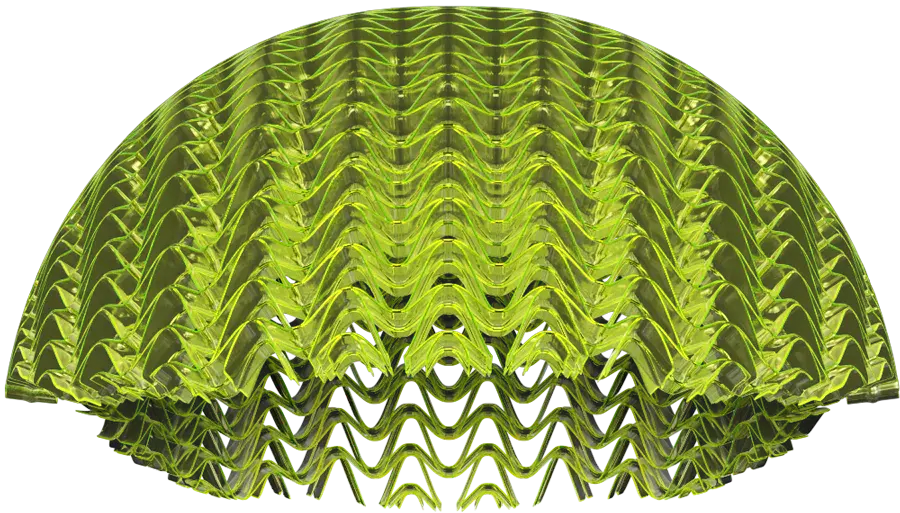

Koroyd is a developer and manufacturer of lattice-like “welded tubular structure”, which it calls an “advanced impact technology.”

Koroyd provides its products and technology to consumer products companies like Smith. Other applications of Koroyd’s technology include other types of helmets (cycling, moto, safety/PPE and equestrian), backpacks, gloves, body armor, snowboards, kiteboards and infant car seats.

In other words, Koroyd is a so-called “ingredient technology” provider.

There is not much information publicly available about the Smith/Koroyd partnership. However, it appears to be an exclusive arrangement whereby Koroyd promised to not license its welded tubular structure technology to any other snow sports helmet manufacturer.

Wavecel is another “ingredient technology” company that also develops and manufactures a helmet-lining product that seeks to absorb and attenuate impact forces. Wavcel describes its technology as “network of hundreds of interconnected shock absorbers connecting your head and the outer shell of the helmet.”

Wavecel got traction early on with Trek, whereby the two companies entered into an agreement to incorporate Wavecel’s product into Trek’s Bontrager bicycle helmets. That agreement provided Trek exclusive use of the Wavcel technology in the cycling helmet category. (In 2021, Trek and Bontrager had their own, separate legal issues concerning these helmets – specifically related to Trek’s marketing claims. However, that case was voluntarily dismissed by the plaintiff 3 months after it was filed.)

In July of 2021, Koroyd and Smith sued Burton in the U.S. District Court for the District of Utah (Salt Lake City).

This U.S. lawsuit alleged Burton’s helmets that used Wavcel’s technology infringed the Smith/Koroyd jointly-owned U.S. patents.

Interestingly, Wavecel was not named in this U.S.-based lawsuit, although it was mentioned in the Smith/Koroyd complaint.

Then, early in 2022, Koroyd and Smith sued Burton in Germany (German Federal Patent Court (Docket No. 7 Ni 1/22 (EP))). That case had similar allegations -- that Burton’s helmets that used Wavcel’s technology infringed Koryod’s German patent (EP 1694 152 B1).

Here again, Wavcel was conspicuously absent.

I suspect Wavecel was absolutely involved behind the scenes and supporting Burton in both of these lawsuits – particularly since it is ultimately the Wavcel technology that is at issue.

In March of last year, after a 2+year long legal battle, the German Federal Patent Court sided with Burton and declared Koroyd’s German patent for its technology invalid.

In June, 2025, SGB Media reported that Koroyd/Smith and Burton have resolved all their disputes.

According to the SGB Media article, the core of the settlement includes an agreement whereby Burton secures exclusive worldwide rights to make, market and sell snow sport helmets that incorporate Wavecel’s technology. This is a typical outcome in these types of patent litigation matters – Burton/Wavcel do not admit (nor has the court apparently found) that the Wavecel inserts read (infringe upon) Koroyd’s patents. But, to resolve the case and move on, Smith/Koroyd have apparently acquiesced and agreed to allow Burton to carry on with its snow sports helmets that incorporate Wavecel impact-absorbing inserts.

Typically, as is the case here, these settlements come in the form of a license or a covenant-not-to-sue.

The SGB Media article also explained that the settlement is limited to the WaveCel technology being used solely by Burton and only “in those licensed, redesigned snow sports helmets and may not be offered, supplied or integrated with any other brands or partners in the snow sports helmet market.”

It seems like this requirement will have just as great an impact on Wavecel as it will on Burton.

Although, based on a review of Wavecel’s website, it appears that Wavcel already had an exclusive arrangement with Burton whereby Wavecel agreed to only license its technology in the snow sports space to Burton.

Further still, “Burton is the only company to whom Koroyd will be licensing its patents for use with WaveCel in the snowsports helmets market. Koroyd stated that it does not intend to issue any other licenses for the use of WaveCel in the snow sports helmet market.” Again, this seems to limit Wavecel as much as it does Burton.

This case is particularly interesting in that it involves two antagonistic competitors in a somewhat niche space (helmets for snow sports).

I don’t know what type of market share they each have. But, when I am on the slopes, my eyeballs tell me that both Burton and Smith are power players in this space.

What’s more interesting is that these two competitors (Smith and Burton) were pitted against each other over “ingredient technology” that they each, respectively, used and licensed from a third party (Koroyd and Wavecel, respectively). That said, it does seem like the Smith/Koroyd relationship is deeper than just a license, since the U.S. patent is jointly owned by both companies.

Take-aways:

In license deals, pay careful attention to the indemnity section. This is particularly important when “licensing in” intellectual property and so-called “ingredient technology”. Consumer products companies licensing in these types of technologies will want strong and broad indemnity provisions in their favor, and this is typically a “to-market” ask.

The rationale is that the licensor should indemnify the licensee for any infringement allegation, based on the sentiment that since the licensor developed the technology, it should stand behind it. Another common argument supporting the position that “licensor pays” is as follows: since the licensor is deriving a royalty in the arrangement, any infringement risk should be on them.

These provisions are often (and I posit, should always be) one of the most attention-getting provisions in any license agreement like this.

It is not uncommon for patent litigation costs to be far more than any royalty derived or paid over the course of the relationship. These indemnity provisions can have massive economic implications.

Finally – even after everyone agrees how infringement allegations/litigation and indemnity will be handled financially, that doesn’t mean you are done:

The parties should carefully explain how indemnity and litigation will be handled. Who will serve as legal counsel for the parties? Who picks legal counsel? Will that legal counsel represent both parties if both are named? Will the indemnity cover both liability and the costs and fees associated with any litigation?

Be careful to make sure any limitations of liability do not contradict or “muddy” the indemnity provisions. If there’s a contradiction (often called a “carve out”), is it intentional? If so, that should be clearly explained.

Regardless, the limitation of liability and damages should be crystal clear in terms of how they impact (or that they do not impact) the indemnity obligations.

Same point when it comes to so-called “damages caps” and “super-caps”. Those can be – and often are – a thing. But they must be carefully worded in terms of how they intersect (or don’t intersect) with the indemnity obligations.

Lawyers are normally pretty good at drafting all these provisions (although I have seen my fair share of bad ones). But the lawyers should NOT be the ones working out the business points. The business folks should bring the lawyers a carefully negotiated plan as to their agreement on indemnity, limitations of liability and liability caps. The lawyers will ask the appropriate questions and make sure that everything is captured correctly.

It is also much more efficient and cost effective when the business folks work out these details first and then take their agreement to their respective legal teams.

.png)

Comments